Ira Max Contribution 2025 Married. Your personal roth ira contribution limit,. The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older.

Ira contribution limits for 202 4 for the 2025 tax year, the maximum contribution you can make to a traditional or roth ira is $7,000. What are 2025 401 (k) and ira max contribution limits?

Key takeaways the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

Ira Contribution Limits 2025 Married Filing Jointly Allys, For 2025, the annual contribution limits on iras increased by $500, bringing the total to $7,000. This cap only applies if.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income. Key takeaways the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

401k Roth Ira Contribution Limits 2025 Emily Ingunna, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was. Increases to 401 (k) and ira contributions for 2025 give you more options to boost your savings.

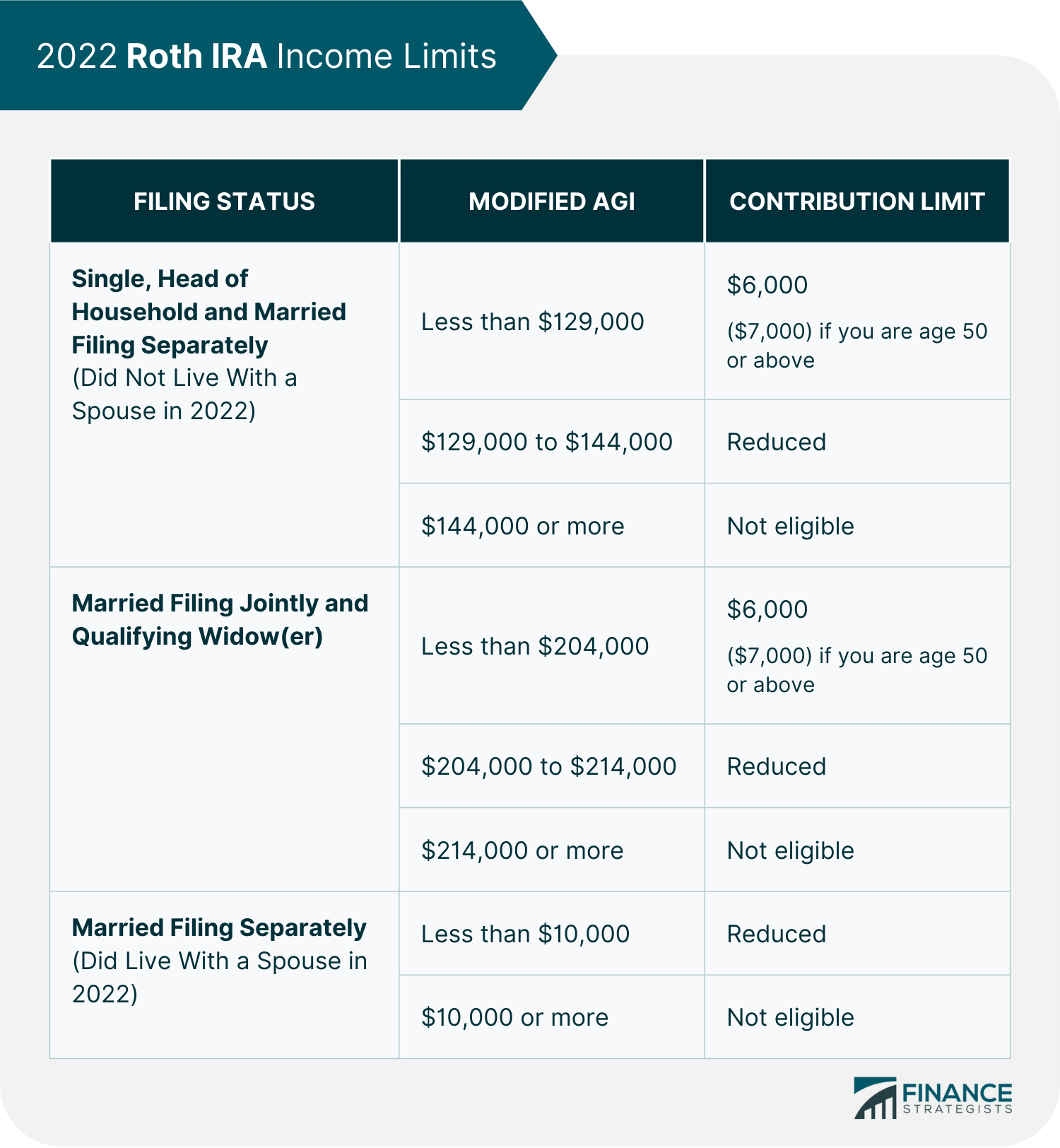

IRA Contribution Limits 2025 Finance Strategists, Roth ira income limits for 2025. You can’t make a roth ira contribution if your modified agi is $153,000 or more.

Ira Contribution Limits 2025 Married Filing Jointly Allys, Traditional ira contribution limits for 2025 the 2025 annual ira contribution limit is $7,000 for individuals under 50, or. Learn about ira contribution limits to help shape your retirement savings plan, and ensure that you are financially.

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, What are 2025 401 (k) and ira max contribution limits? The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

Ira Limit For 2025, Key takeaways the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. Ira contribution limits for 2025 and 2025.

2025 Maximum Roth Contribution Erma Odetta, Your filing status is married filing separately, you lived with your spouse at any time during the. Learn about tax deductions, iras and work retirement plans, spousal iras and more.

Max 401k Contribution 2025 Married Couple Helen Kristen, Roth ira income limits for 2025. Roth ira contribution limits have gone up for 2025.

Married Filing Jointly Roth Limits 2025 Una Lindsey, Key takeaways the roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. Learn about tax deductions, iras and work retirement plans, spousal iras and more.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was.